I was waiting for someone to semi-confirm my suspicions and Martin Armstrong might have done just that! China desperately needs money to help combat the dire real estate situation it’s in and might have been selling UST’s at an uncomfortable pace, or, made a threat US could not ignore.

Blinken - Sent to China to make the general deal

Yellen - Sent to work out the logistics (No Treasury Secretary has ever been sent to China solo.)

Kissinger - To smooth out the wrinkles, even though he can’t smooth out his own.

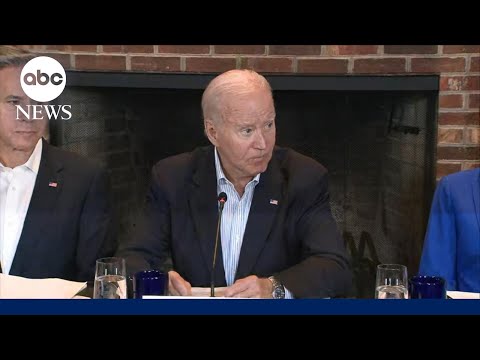

Biden then arranged a ‘Summit’ at Camp David with Japan, largest holder of US Treasuries outside of US (China is 2nd) and So. Korea, which has the industrial base in the region to help take the place of Taiwan and China output; and also keep No. Korea in check. Then, there’s the geography of Guam, eastward to soon-to-be-port on Maui, to California. It doesn’t get anymore perfect!

Let the fireworks fly! The Fed has been raising rates not to combat inflation; maybe a little, but more to combat China. Buckle up! It’s sure being kept quiet; not a peep.

I’m placing this on BRI thread along with a great interview with Jeffery Sachs.

Video time 9:15 to 9:45. Note this video was made 4 months ago, before Blinkin, Winkin and Knod made trips to China.

“Can history help us predict market cycles?” with Martin Armstrong