Originally published at: THE STATES' REVOLT AGAINST FED'S "MONEY FACSIMILE" GROWS

We must, before doing or saying anything else in this blog, firstly thank W.G. for spotting and sharing these stories. The reason why is rather simple: because thus far the revolt of the states in passing state legislation recognizing gold and silver as money and legal tender, and of states opening their own bullion depositories,…

I think this is very much connected to Yellen’s trip to China. 3 reasons come to mind:

The ban on exporting rare earth minerals is one. The minerals are not that rare but it would cause havoc and slow down production of EV’s etc., which would be a great thing in my book.

Second is the upcoming announcement of the new gold-backed BRICS currency (July 12 or thereabouts?). Other than the current BRICS nations involved, there are 14 more nations who want to participate in that system.

Third and most immediate is the very large amount of U.S. Treasuries that China holds. There might have been a threat via back channels by China that if U.S. could not come to agreement, they would just dump the Bills on the open market. That would send U.S. economy into a major tailspin.

Meanwhile, Fed Powell is draining as much liquidity out of the system as possible now that it’s perceived that the initial banking crisis is over (not). Whether this is in prep for CBDC (JPM to handle?), or, threat of Bills dump, etc.; likely a combo of all. Lots of balls in the air right now.

I’ve heard of Sec of State traveling to China and a myriad of others but don’t ever remember any Treasury Sec. making a lone trip to China. Yellen obviously wants no interference from other representatives regarding whatever deal she’s trying to make. This appears to be a big time, USD, money matter, as most things are.

What I cannot find is the in-depth interview with this man.

He says phones will be greatly affected by the ban and would have to default to older tech.

I have to wonder if that would axe 5G?

If and when States commit to convertibility of physical certificates it will also represent the re-establishment of the Royal Prerogative of money.

Alex Del Mar, The Science of Money p.xiv, p.xv

"Since the enactment of the law of 1666, which destroyed Money as a Public Measure, and surrendered the regulation of its volume to private hands, those hands have, through its powerful agency, grasped control not only of all metallic money but also of a considerable portion of other wealth of the kingdom. Among the various devices procured or employed by them have been: I. Frequent alterations of the ratio between gold and silver coins. These alterations have since been ascribed to the work of nature, the operation of the market, the caprice of princes, and a variety of other fanciful causes. The petitions, cashiers and plankkarts of the period to which they refer, prove that they often originated with the money-lenders themselves. II. Changing the material of the full legal tender coins from gold to silver, or silver to gold. III. Issuing convertible notes upon an inconvertible basis. IV. Alternately selling and shrinking the currencies of particular States, by monopolising the produce of mines, shipping bullion to and fro, transferring securities from one State to another, speculating in exchange, and other like practices. The colossal profits of these operations have been drawn from the channels of Industry, which now demands, not yet an indemnity, but such a settlement of the monetary laws as will cease to afford facilities for their repetition.

The basis of such a settlement must be the re-establishment of the Royal Prerogative of money, that complete restoration of its control by the State, without which experience has abundantly shown that the preservation of equitable relations between the various individuals and classes of society is utterly impossible."

One issue with state control of money is the state is comprised of individuals who can be compromised, back where we started. The “state” is a myth.

Indeed! I went into some detail about that crucial gold-silver ratio in my book Babylon’s Banksters, which in turn relied upon the interesting study of David Astle.

ULTRA wise question brother!

Assuming the Dollar does fail and states create bullion backed commodity money, do you suspect the CBDCs and or Cryptos will be the privately issued money?

Joseph P. Farrell, Babylon’s Banksters P. 190

In other words, at a certain juncture and by the nature of the case, there will be two monies in circulation, one created by a private group and based on bullion commodity money issued as a facsimile of the state money for which it can be traded and substituted, and the second, the original state-issued money. It should be noted that this situation is almost exactly paralleled in modern times by the issuance of state money and private notes both in England and in the United States. In both the ancient and modern instances, the privately issued money gradually and with inexorable inevitability replaces the state issuance, and with that occurrence, the power of the private issuers of such monies is established over a society.

I think neither, because people will realize the necessity of a physical medium of exchange both for privacy and security. A crypto “currency” as I and Catherine Fitts have REPEATEDLY said is NOT a currency. It’s a corporate coupon at best.

I agree with both you and Catherine (and others) so much so, that I now exchange my dollars for bullion. I no longer save in dollars nor will I buy treasuries. When the restructuring comes a lot will be up for grabs. For instance, with the right to coin money comes the choice to do so with interest or not. Eliminating or substantially reducing the public burden of interest payments on money creation could be a great improvement for everyone.

When people realize the necessity of a physical medium of exchange both for privacy and security, I hope they also realize, we need not pay interest for the creation of said medium.

If some states do begin creating money what role do you imagine the temples and trusts playing?

Frank Dixon, Public Versus Private Sector Money Creation: Society Enhancing money Reform

"In 1896, US presidential candidate William Jennings Bryan said, “we believe that the right to coin and issue money is a function of government… We believe that it is a part of sovereignty, and can no more with safety be delegated to private individuals than we could afford to delegate to private individuals the power to make penal statutes or levy taxes… I stand with Jefferson rather than with [banks], and tell them, as he did, that the issue of money is a function of government, and that the banks ought to go out of the governing business.”

"In 1941, Congressman Wright Patman, Chairman of the House Committee on Banking and Currency for twelve years, said, “I have never yet had anyone who could, through the use of logic and reason, justify the Federal Government borrowing the use of its own money… It is absolutely wrong for the Government to issue interest-bearing obligations… Now, take the Panama Canal bonds. They amounted to… $49 million… By the time they are paid, the Government will have paid $75 million in interest on bonds of less than $50 million. So the Government is paying out $125 million to obtain the use of $49 million… The question is: Should that policy be continued? … I believe the system should be changed. The Constitution of the United States does not give the banks the power to create money…”

Sohn 2023 | Kiril Sokoloff in conversation with Stanley Druckenmiller

"An existential threat to American capitalism in 2040, entitlements plus interest will become greater than taxes… There is no money except for entitlements. We are absolutely going to cut entitlements in this country, it is a lie and a fantasy to say that we don’t have to cut entitlements, The problem is we either cut them now or cut them later. If we cut them later the interest expense which is already said by the Congressional Budget Office to go from 8 to 27% of GDP

Wow brother! Question everything indeed! Very good information, that point in 2040 is very special, since is also the very moment that another planet is going to enter the Solar System, wreaking havoc in earths biosphere.

Now we have 2 focal points for chaos, the financial angle is new to me.

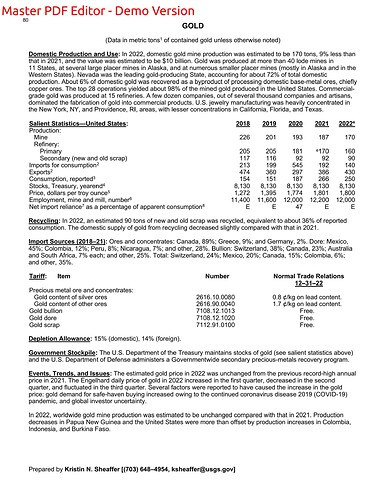

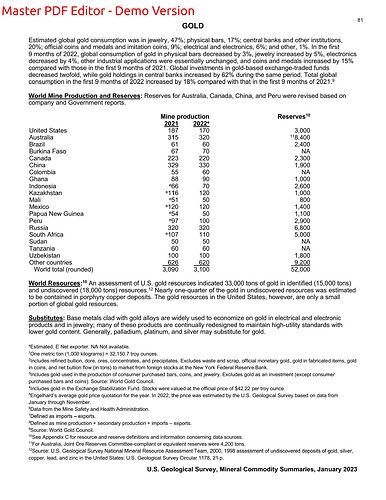

“The U.S. Department of the Treasury maintains stocks of gold” One metric ton (1,000 kilograms) = 32150.7 troy ounces

Current gold stock pile = 8130 x 32150.7 = 261,385,191 t oz. x $1947.87/t oz = $509,144,371,993.17

“U.S. Mint balance in U.S. Mint only”

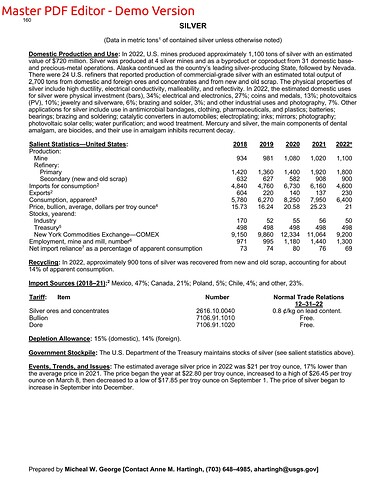

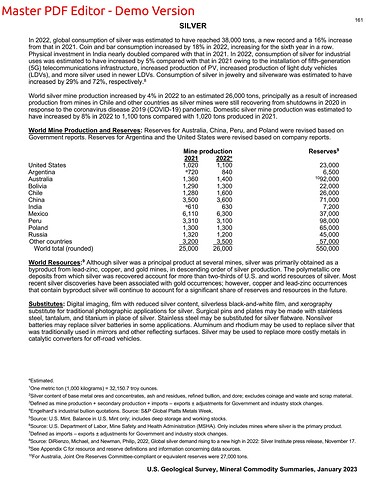

Current silver stock pile =498 x32150.7 = 16,011,048.6 t oz. x $23.36/t oz = $374,018,095.30

Brazil = 129.65

Russia = 2326.52

India = 794.62

China = 2068.36

South Africa = 125.38

BRICS = 5444.53

Data are taken from the International Monetary Fund’s International Financial Statistics (IFS), May 2023 edition, and other sources where applicable

I guess that is another reason some people beleive in the altristic AI god that could be the objective and fair guardian of humanity.

Wise observation. State is a tool for resource straction of the less strong elements in a given field of social life.