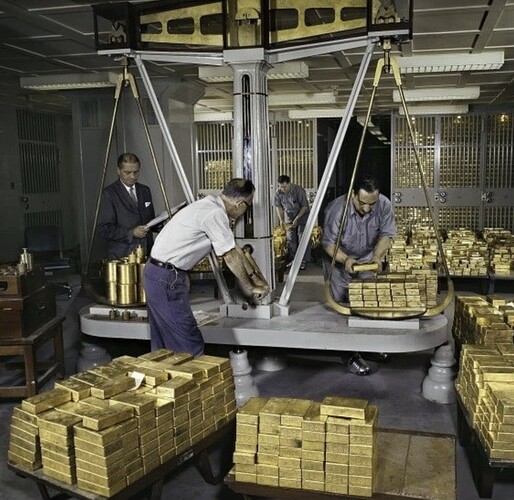

Gold Depository at the New York Federal Reserve, 1959. The basement floor of the main office building in Manhattan houses the New York Fed’s gold vault, constructed in the early 1920s. This secure vault serves as a storage facility for monetary gold reserves, safeguarding the holdings of various account holders, such as the U.S. government, foreign governments, and central banks. It’s important to note that individual or private sector entities are not allowed to store their gold in this vault.

A significant portion of the gold currently stored in the vault arrived during and after World War II when many countries sought a safe location for their gold reserves. The vault’s holdings reached their zenith in 1973, shortly after the United States suspended the conversion of dollars into gold for foreign governments. At its peak, the vault held over 12,000 tons of monetary gold. Over time, gold deposit and withdrawal activity has slowed, resulting in a gradual decline in overall holdings. Nevertheless, as of 2019, this vault remains the world’s largest known repository of monetary gold, containing approximately 497,000 gold bars with a total weight of about 6,190 tons.