With thanks to bluefalken.

Klaus von Commie Schnitzel’s cyber attack, inbound.

Thanks neru, it’s hard to know what to do and I’m trying to avoid to play right into their hands…

by the way the CHD link special report couldn’t have been more timely. listening now, thank you

Whow, Robert_Barricklow really good articles, thank you.

I have heard hours and hours of commentary, I think Michael Hudson and John Titus are the ones who have provided the best analysis on the collapse and most succinctly summarized it.

When I first moved to the US 5 years ago I knew about the structural failure of the system and gave myself roughly 5 years to do what I could and then see if I had to return back home (Europe) or not to avoid the collapse which I knew was coming. Turns out there’s nowhere to go as Europe has undergone controlled demolition.

I don’t have nearly enough money to buy a house (live in California) so I’m exposed and not sure what to do…

Hi TamaraScott,

thank you for your candid response. (I forgot that people can be nice on the internet). I wish that I had enough money to buy property but I simply do not. I’m a PhD Principal Research Scientist with roughly 20 years of academic research behind me (cell and molecular cancer biology) and living off of grants and fellowships for most of that time has led to me being a 40-something year old who owns nothing and is (not very) happy.

When I moved to California in 2018 to work in the private sector for a double-digit billion revenue pharmaceutical company I thought I could earn enough to save to buy a home. Five years later my savings have stopped far short of being able to buy anything as our wages keep rising far less than inflation so year on year I end up being poorer. And now I risk losing what little I have saved up which constitutes my lifetime savings. It’s a sad state of affairs.

I also liked FRB because it’s smaller size compared to the too big to fail banks implied more ethical business standards. Makes sense ‘they’ would like to demolish it and already the data suggest people are acting ‘as expected’ and withdrawing their funds to put to bigger banks.

The private armies concept from CAF is a good one, I’ll consider it.

Best of luck to you too !

Getting out of California might be the way to go, unless you still have work there that is worth staying for.

Land can be a good investment, at least in the current times but if the government collapses land ownership isn’t really valid unless enforced by police or a private army. I believe this was the original reason why there even were any police departments established here in North America, to drive the Indians off land claimed to be owned by the new folks who sailed over the ocean and declared this new continent to be their property.

If I had savings enough to put down a payment for some land I might do that, but would probably invest more in building houses or other buildings that can be moved on truck/trailers or ships so they could be re-located if there were problems with neighbors that couldn’t be worked out somehow.

Investing in boats or vehicles that will retain their value could also be a safer investment than land or buildings.

I’ve been so taken with “mini-houses.”

With thanks to omnimatter.

With thanks to omnimatter.

With thanks to RB.

Yes, getting out of this godforsaken (literally) state is our number one priority. Unfortunately, I am not allowed to work anywhere else than my current employer (think of indentured servancy, aka non-immigrant visa) so trying to get my green card: this is its own story in arbitrary tyranny from the USCIS as they require people to have proof of injection with mRNA to be granted permanent residence status (also, flu shot, but only between October and April). It’s all a joke.

We are considering leaving the US altogether but question is whereto.

Oh that sounds difficult to deal with, where are you from then you could return to your home country or would be better to go somewhere else?

South America. Uruguay.

Interesting, we were thinking Argentina for similar reasons, Uruguay might be better

It is estimated that the bank had nearly 14 billion in uninsured foreign deposits. According to this report, SVB’s failure is rippling into China. Thousands of Chinese companies are listed among the bank’s clients—with over $240 million in assets on the line—and 57 are on a special list belonging to the Chinese Communist Party.

Discussion of digital passport patents and related research:

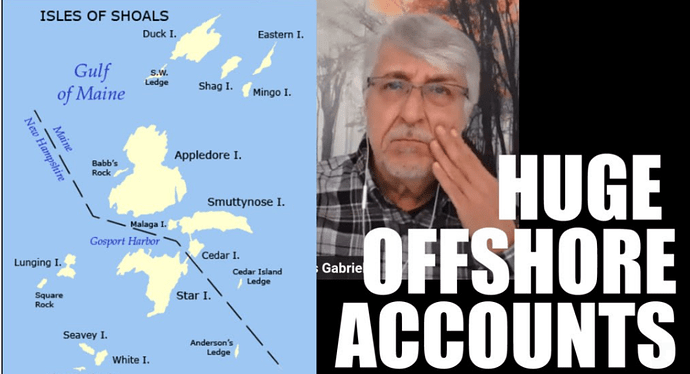

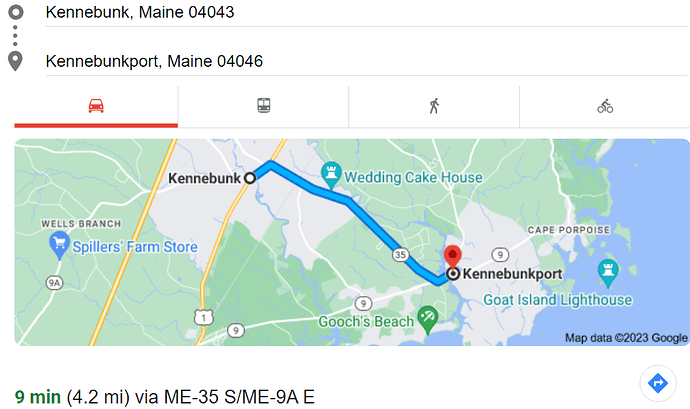

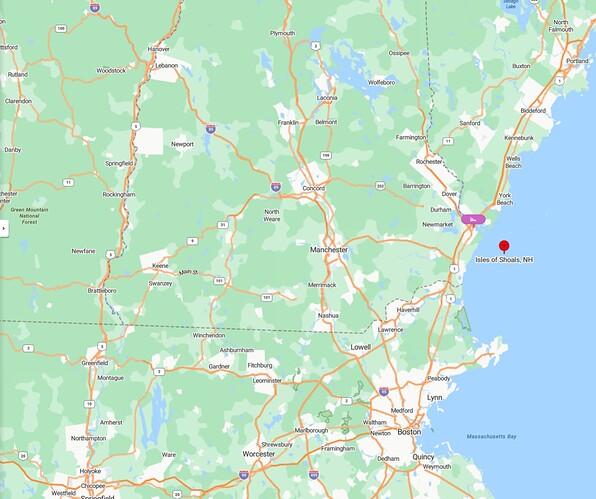

Follow-up research on a 3-13-23 connection  between the SVC bank collapse and money laundering in the State of New Hampshire:

between the SVC bank collapse and money laundering in the State of New Hampshire:

4-5-23: Huge Offshore Accounts

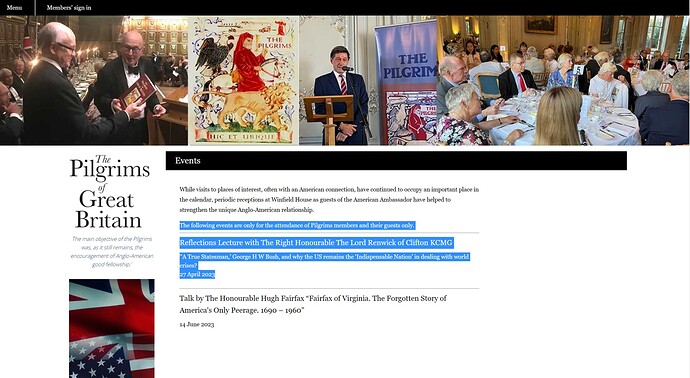

April 27, 2023: Upcoming Royal Reflection Lecture on George HW Bush, “A True Statesman” website announcement