Have been watching the before and after the 3 Amigos trips earlier this year.

Not looking good for U.S. Treasuries but it could be worse. UST’s is a huge market and unless it’s about $18B per week, we might have time to adjust. I suspect this is why Biden met with Japanese and So. Korea at Camp David. China is 2nd largest UST holder but Japan is #1 of those outside USA.

Ive read that the Saudis holds basicly an enourmous but totally hidden amount of these…

Noone on the official level has any idea since its basicly under tape etc.

Ok, let’s see what this system from The West does to the fires. I don’t know their intent, whether to speed up the spread or to douse them.

Like the space race; one has the high-tech road to/for markets/wars,

the other…

@Robert_Barricklow

I’m not so sure they’re running out of money; maybe CCP is running low but not India and others.

If they want to sell to W. Europe, Russia and others, they need that pathway.

U.S. Fed, Treasury, etc. doing their best to prevent it. At this typing, the 10-yr. bond yield is 4.61%. That’s huge and U.S. bonds cratering, which, IMO, is what Fed/Treasury, etc. want to happen to prevent CCP & others from having the funds. Special deals made with Japan & So. Korea though. Would have loved to have been a fly at that Camp David picnic. This inflation business is completely set-up to take down China, Russia, BRICS/BRI.

See what I mean? And I think it’s a hell of a lot more than $113B.

They’re stealing like they’ll be no tomorrow.

Like they won’t be around, to steal the next election.

Or, someone else is taking over the criminal enterprise.

Steal as much as you can; while your in the driver’s seat.

Who cares if it all comes crashing down; because you’ll be more than flush, when it does.

Ah, I think there might be a bit more than a glimmer of truth in this and why US Treasury, Fed, etc. are trying to crash China’s economy.

Oil is more bang for the buck.

Green energy is a pipe dream; or, is it a pauper’s dream.

I’ll save you the time, if Rickards’ opinion is all you’re after… However, there’s a report on store closings at the beginning of the podcast (~3200 various stores).

“Unfortunately, a lot of analysts pick this up and run with it and come up with all kinds of crazy talk that gets out there – the Great Reset, the end of the dollar, etc. – none of which is true.”

– Jim Rickards

On this week’s Stansberry Investor Hour, Dan and Corey are joined by renowned economist Jim Rickards. Jim details his illustrious career, the development of the BRICS (Brazil, Russia, India, China, and South Africa) currency, and its potential ramifications for the global monetary system.

Dan and Corey kick off the podcast by discussing store closures, Amazon’s monopoly allegations, and commercial real estate’s decline. Recently, major retailers like Target and CVS Health have announced they’re shuttering more stores. While some of these closures are due to organized crime, most are because of the shift to online shopping. As Corey points out, “It’s tough to be a brick-and-mortar retailer in today’s environment.” However, Dan notes the irony in this situation. Amazon, which is facing monopoly allegations, thrives in this competitive environment…

Here’s Amazon being sued… for being a “monopoly” and doing all kinds of brutal stuff to keep its alleged monopoly in e-commerce… I was like, well, that’s how you know what a fantastic business it is.

Next, Jim joins the conversation to share some of what he has learned during his storied career, specifically from being the general counsel on a hedge fund’s $3.6 billion rescue deal. He also explains why he grew dissatisfied with risk management and how he became one of the first in finance to use “complexity theory.” Though the idea is borrowed from physics, Jim has used it throughout his career to understand risk in the markets.

Dan then steers the conversation to the BRICS initiative – i.e., the five countries’ goal to create an alternative currency that will challenge the dominance of the U.S. dollar. Jim explains the origins of BRICS, highlighting how they have created financial institutions similar to the World Bank and the International Monetary Fund. This, Jim points out, was a strategic move to gain greater control over their economic affairs…

They’re recreating the Bretton Woods Institutions under their own control and in their own preferred format.

Jim stresses the significance of the BRICS currency, as it would facilitate trade among member nations without the need to rely on the U.S. dollar. By using a shared currency, countries within the agreement could conduct commerce among themselves more seamlessly…

Now you launch your BRICS currency… So now you can go shopping. You can go to Brazil and buy Embraer aircraft. You can go to China and buy semiconductors.

However, Jim emphasizes that a BRICS currency should not be interpreted as the end of the U.S. dollar’s reign. Rather, it would be a formidable competitor in the global currency arena. As he stresses…

Currencies don’t disappear overnight. Currencies don’t dominate overnight. You can have more than one reserve currency, which we did then and do now. And so what I see is the BRICS currency will emerge, will start as a trade currency over time, [and will] become a reserve currency. It doesn’t mean the end of the dollar.

This truly is a big deal. I’ve been to Jakarta and population ranks 2nd highest in the world, with Tokyo being first.

Do they have enough illegal immigrants now to labor as needed? The balance is between illegals and losing the election? Too many women and children accompanying now? Winter coming and soon it will be time to get the men to work.

The headlines tend to cause the reader to think the entire wall is to be built. Starr County is only a small area that is heavily patrolled not far from McAllen Texas.

The area includes a popular recreational and wildlife area. Hence the need for all the exemptions.

The environmentalists are going to go gaga.

This is why people should read past the headlines.

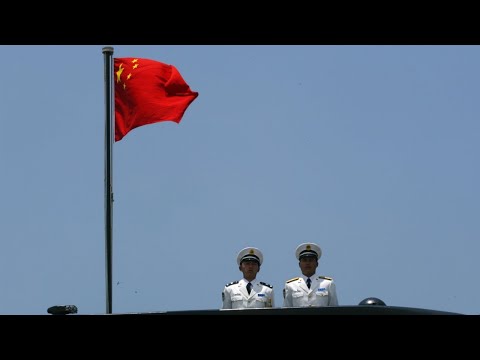

Have been doing a bit of research on The Chinese Navy (TCN).

There’s no way by conventional means TCN can effectively take Taiwan without losing most every boat they have. They could use missiles, if they’re operational, don’t misfire, etc. The problem is they don’t have the leadership in strategy or tactics that’s truly needed to handle the situation, given the horrible sub blunder of falling into their own trap. The real worry is they will cause major damage by mistake/accident to Taiwan and surrounding areas, even to opposing naval vessels, unintentionally.

The biggest and about the only damage China can do to The West is economic. The more I study the situation, the more I’m convinced the “Chiieena” threat is mostly lies. Xi has little to no leadership abilities and those who do are hesitant to step forward (to say the least).

At this point, I believe the only remotely workable advice that Xi receives is from Putin.

Happened in August.